(Click here for best resolution)

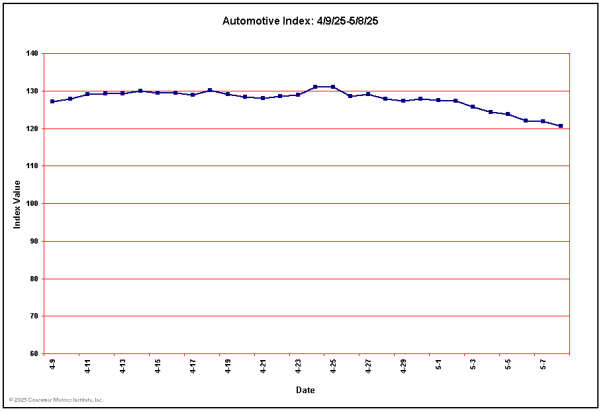

Last 10 Automotive Index Values

| Date: | 05/27/2025 | 05/28/2025 | 05/29/2025 | 05/30/2025 | 05/31/2025 | 06/01/2025 | 06/02/2025 | 06/03/2025 | 06/04/2025 | 06/05/2025 |

| Value: | 113.83 | 113.87 | 114.07 | 115.45 | 116.29 | 117.28 | 118.16 | 118.30 | 119.02 | 119.35 |