| Consumer Metrics Institute News Feed Subscribe to Consumer Metrics Institute News by Email |

Consumer Metrics Institute

Home of Daily Consumer Leading Indicators

| Consumer Metrics InstituteHome of Daily Consumer Leading Indicators |

| Home | History | Automotive | Entertainment | Financial | Health | Household | Housing | Recreation | Retail | Technology | Travel | FAQs | Downloads | Membership | Contact | About |

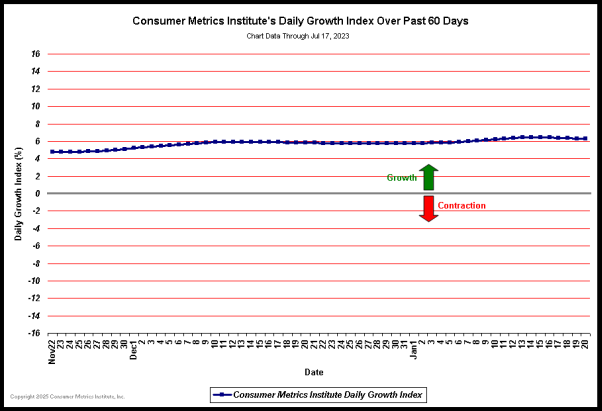

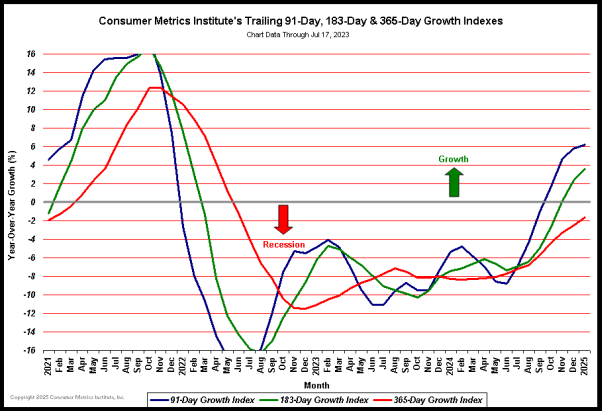

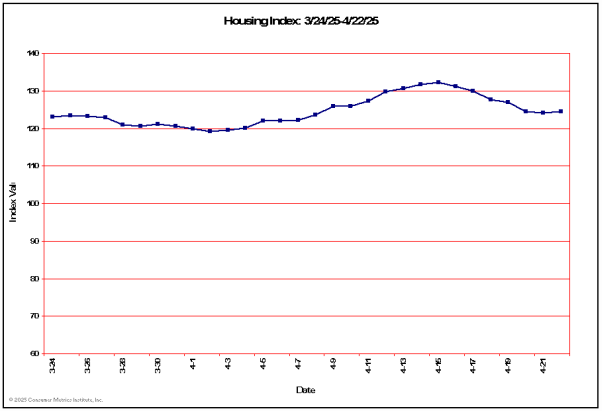

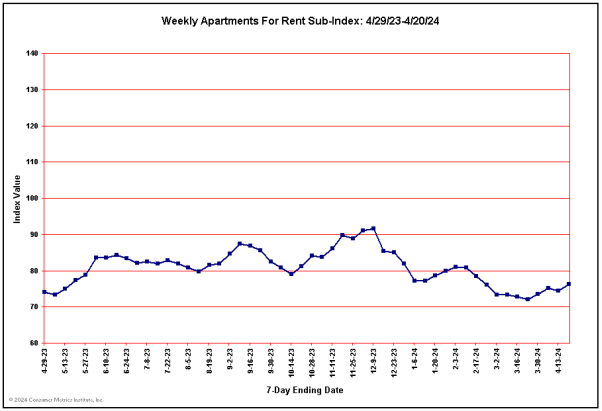

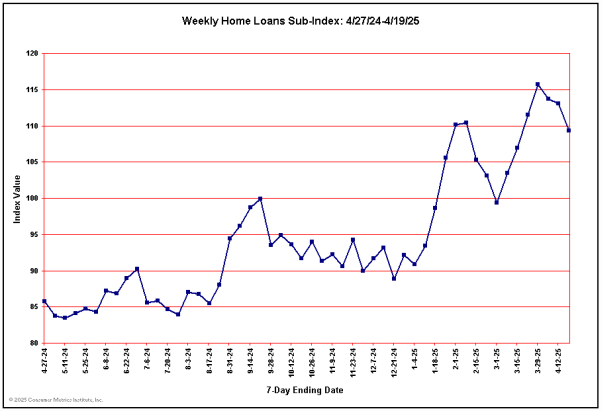

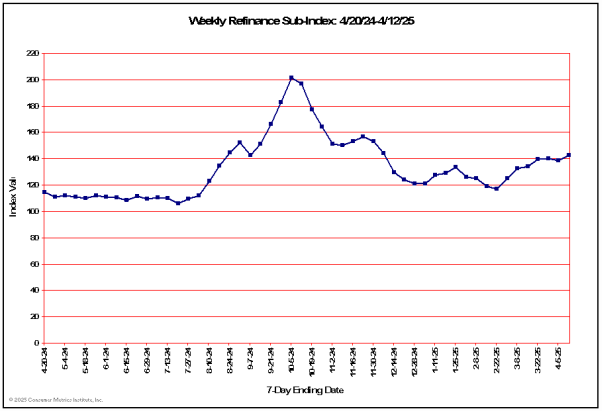

| April 16, 2011 - New Records and "Unthinkable" Sovereign Debt End-Games: On April 13, our Daily Growth Index sank to a level that exceeded anything we have seen before, surpassing the previous record low set on October 4, 2010:  (Click on chart for fuller resolution) But the length of the contraction is perhaps its most defining characteristic, because it has long since sucked our longer term 183-day and 365-day trailing indexes to levels that have been below their 2008 bottoms every single day since September of last year:  (Click on chart for fuller resolution) The cause for this situation is not hard to find. Of late our Housing Index has been dismal:  And the supporting sub-sector charts in the Housing Sector are showing no signs of life:   Not so coincidentally, both financing and re-financing activities related to the housing market continue to show year-over-year declines in excess of 30%:   None of this is good for the economy as a whole. Even as transaction counts at major retailers may look good, the inflation adjusted real commerce behind those transactions has dropped on a year-over-year basis. Even the year-over-year growth in the Automotive Sector is now coming exclusively from the Korean manufacturers -- hardly a sign of American consumers feeling confident in their long term welfare, let alone opulence. Even if QE-2 officially ends in June, we feel certain that the economy will give Mr. Bernanke all the excuses that he needs to pick up again right where he left off. Sovereign Debt End-Games Revisited - The "Unthinkables" Our recent posting on the historical perspective of sovereign debt end-games has generated a lot of interest. Our underlying premise was simple: if none of the "normal" or conventional economic options can possibly improve the U.S. debt/GDP ratio, then that ratio will be ultimately be fixed by unconventional (or "unthinkable") means (i.e., the socio-economic equivalent of Arthur Conan Doyle's famous observation that "when you have eliminated the impossible, whatever remains, however improbable, must be the truth"). In this context "possible" means much more than economically feasible -- a "possible" solution must also be politically, socially and culturally acceptable to enough of the electorate to make it all the way into law. And any "possible" solution has to remain the law of the land long enough for it to accomplish its goals (e.g., the Irish and Icelandic electorate ultimately rejected fully negotiated political/diplomatic resolutions to their particular debt issues long after the politicians, diplomats and economists thought that they had a "done deal"). Let's broadly divide the "unthinkable" options into two broad classes: those that preserve the core of the current regime, and those that don't: Unthinkable But Regime Preserving End-Games By "regime preserving" we mean end-games that don't need the sweeping systemic changes that characterized the administrations of Andrew Jackson or Franklin Roosevelt. In fact, the regime preserving end-games discussed below could keep most of the current institutions (e.g., the Federal Reserve) in place, even if those institutions are pushed far outside of their conventional operating zones. The Federal Reserve Bank of the United States is interesting in this context for a number of reasons. It was created in 1913 by the Federal Reserve Act, but it is neither enshrined in the United States Constitution nor owned by the U.S. Government. Although its Board of Governors is appointed by the president (subject to consent by the Senate), the twelve regional member banks are actually privately owned by commercial banks in their districts -- a unique arrangement among all the central banks throughout the world. But the lack of constitutional authorization carries with it a flip side: there are no constitutional restrictions on what it can (or can't) do, given a sufficiently compliant Treasury. Furthermore, congressional acts can shape, direct and expand the powers of the Fed at will (without constitutional changes, direct electoral referendums or political upheavals) -- not to mention what a sufficiently ingenious Federal Reserve Chairman can do while Congress dithers or obsesses over other matters. (A disclaimer of sorts: At the Consumer Metrics Institute we understand that real-world economics are really an art of what is politically possible (with Ireland and Iceland serving as fresh reminders). Although we feel that extreme experiments in Keynesian economics have never been a successful sovereign debt end-game, we also understand the political allure of deficit spending that carries with it only deferred consequences. In that context the discussions below are not recommendations -- they are merely observations of some politically viable options available to an increasingly desperate cast of economic bureaucrats.) At minimum several versions of a "Fed gone wild" end-game come to mind: ► Option 1: Kicking the can down the road. In a recent post we considered the possibility of the Federal Reserve continuing to follow the blueprint provided by the Bank of Japan -- Quantitative Easing (QE) ad infinitum. Although this does not resolve the precarious debt/GDP ratio, it could make it affordable for an extended period of time. In fact, the Japanese experiment has proven that debt/GDP ratios over twice what the U.S. is currently experiencing can be sustained with apparent impunity. Unfortunately, the Japanese blueprint has not fixed even the Japanese problem. Ten years into their form of QE the debt/GDP ratio has only gotten worse and there is no exit strategy in sight. It is interesting to note that the recent actions of the Federal Reserve (and Bank of Japan) to de-facto monetize sovereign debt are barred constitutionally in the EU and in nearly all developed countries -- where some combination of governmental austerity, higher taxes, external bailouts and/or lender haircuts are the necessary remedies for unsustainable budget deficits. It is of little wonder that the European central banks are howling over the Fed's current practice, if for no other reason than that it amounts in some regards to a sanitized currency war reminiscent of the international "beggar thy neighbor" tactics that significantly deepened the Great Depression. Additionally, the Fed's current practices are inflicting collateral damage on most still-developing economies by supplying the vast amounts of excess money-center bank liquidity that are funding speculative food and energy price bubbles. But even if the Federal Reserve can magically levitate the U.S. debt/GDP ratio far past the 1:1 tipping point identified by Carmen Reinhardt and Kenneth Rogoff (much like the Japanese have done), the current 1:1 ratio only addresses the U.S. Government's current on-book "funded" liabilities. If we include the present value of unfunded liabilities (e.g., Medicare and Social Security) the real current ratio is something well above 5:1, which would tax even the creative minds at the Federal Reserve. Reinhardt and Rogoff have studied the historical data and concluded that there is no reason to believe that "this time" will be different -- credit bubbles (commercial or sovereign) ultimately collapse, however clever or advanced the lenders and borrowers may think themselves to be. Sadly, irrespective of its futility, QE ad infinitum is quick, easy and politically expedient. It will almost certainly be used to kick the debt/GDP-can down the road at least a little longer. ► Option 2: Maiden Lane on steroids. Maiden Lane LLC (ML-LLC) was formed in March 2008 to "to facilitate JPMorgan Chase & Co.’s merger with Bear Stearns Companies, Inc. (Bear Stearns) and prevent the contagion affects of Bear Stearns’s disorderly collapse to the broader U.S. economy." ML-LLC then promptly borrowed $28.82 billion directly from the Federal Reserve Bank of New York to "to purchase a portfolio of mortgage-related securities, residential and commercial mortgage whole loans and associated hedges (derivatives) from Bear Stearns." Subsequent Maiden Lanes II & III were created to facilitate a similar bailout of American International Group, Inc. (AIG). The concept behind ML-LLC was simple: have the Federal Reserve fund a trust that can take toxic assets off the hands of banks, and then use the patience (and deep pockets) of the Fed to allow a large portion of those toxic assets to have at least some chance of reaching maturity. Additionally, the Federal Reserve used some ingenuity to create the ML-LLC class of "Special Purpose Vehicles" (SPV) -- as a work-around to the Federal Reserve having to directly buy the more derivative of the securities. Such SPV funds had been essentially "unthinkable" prior to the emergencies created by Lehman Brothers, Bear Stearns and AIG during the 2007-2008 Financial Crisis. One interesting aspect of the SPV class of funds is that, unlike Treasury debt, they don't have statutory limits. Nor do they appear in the Federal budget or on the Federal balance sheet. And consider this: without congressional authorization, direction or oversight, Mr. Bernanke "spent" $2.2 trillion in QE-1 and QE-2 monies (buying treasuries and mortgage backed securities) -- nearly four times the spending portion of the American Recovery and Reinvestment Act of 2009 (ARRA). With the Federal Reserve having recently set precedents with multi-trillion dollar balance sheet expansions and SPVs, it would clearly not require a regime change to provide economic stimulus via a sufficiently ingenious super-sized SPV. Let's be truly "unthinkable": how about $100 billion in really cheap new loan monies to be administered by the Small Business Administration? Or perhaps $1.5 trillion to purchase distressed residential mortgages (and quoting from two paragraphs above: "and then use the patience (and deep pockets) of the Fed to allow a large portion of those toxic assets to have at least some chance of reaching maturity")? The Federal Reserve Bank of the United States was formed in 1913 under a mandate to be the "lender of last resort." In the 1913 context that meant the creation of a bank with arbitrarily deep pockets that could stop a manic run on the nation's bank deposits by lending monies even after the normal reserves in the banking system had dried up. A super-sized Maiden Lane as outlined above could broaden that mandate to make the Federal Reserve also the "lender of last resort" into the broad commerce of the United States when banks choose not to deploy what excess reserves they already have. In this mode the funding for the SPV could simply come from those same excess bank reserves on a "use it or lose it" basis. Make no mistake about it: Maiden Lane on steroids would be Keynesian stimulation in every sense of the term -- except, of course, that the debt would be hidden off of the Federal balance sheet (and safely away from Federal debt ceiling legislation) in a way that would make the boys from Enron proud. ► Option 3: De-Priming the Dealers. QE-1 and QE-2 were implemented, like all Federal Reserve open market transactions, through a set of 20 "Primary Dealers" that include all the usual money-center suspects (including, of course, Goldman, Sachs & Co.). We understand the convenience of dealing again and again with the same privileged set of money-center banks, but effective economic stimulation likely requires something more than mere convenience. Should the Federal Reserve decide to extend QE (and presuming that it really does want to stimulate the economy), it should inject the liquidity into far more than the 20 "primary dealers." There are over 2,500 member banks in the Federal Reserve System (the actual owners of the Federal Reserve). How about some equitable treatment for all the owners of the Fed? And if they democratize using that inconvenient "unthinkable," they could also expand the Federal Reserve membership roles substantially to include the bulk of the other 2,500 or so demonstrably solvent U.S. banks -- providing much needed capital into productive "Main Street" commerce. And from the taxpayers' perspective, having 5,000 banks bidding on smaller lots of freshly minted Treasuries should improve the total revenue generated from the auction process -- thereby driving down the cost of financing the deficit. Although this is not technically a regime change (i.e., it doesn't require any new agencies, elections or enabling legislation), it certainly is a "regime change" for the money-center financial oligarchy (or perhaps more accurately: crony-archy). Primary Dealers have led a privileged life; they are the "Too Big To Fail" banks for which the Federal Reserve set up the previously unthinkable "Primary Dealers Credit Facility" (PDCF) to allow borrowings at the Federal Reserve's "Discount Window" using mortgage-backed loans as collateral. No other member banks had access to similarly collateralized "Discount Window" loans. This is the most "unthinkable" of the regime saving options for the money-center elite, since it pulls out from under them one of their key privileges (and major sources of profit) -- basically transferring future wealth from them to the banks of "Main Street" America. But it would also make the Federal Reserve far better equipped to actually become the "lender of last resort" to heartland banks -- a role that it failed at so miserably during the Great Depression that a separate agency (the Federal Deposit Insurance Corporation (FDIC)) had to be created (as part of the late lamented Glass–Steagall Act of 1933) to protect the depositors from their own baser stampeding instincts. And perhaps most importantly, in this scenario any new liquidity injected by the Fed would start out being much closer to the small businesses and unemployed workers of "Main Street" America. ► Option 4: That 70's Show. It doesn't take hyperinflation to shrink "real" debt denominated in the falling currency. From 1977 through 1981 the "real" U.S. debt shrank by about 1.5% even as the U.S. Government ran deficits amounting to an aggregate 20% of 1976's GDP -- and the debt/GDP ratio improved (i.e., dropped) modestly from 35% to 32%. And had the U.S. Government had been able to balance their budget over that same five year period, the debt/GDP ratio would have shrunk to 20% -- reducing the ratio by over 40%. The latter part of the 1970's was a period of high inflation, with the inflation rate averaging 9.8% from 1977 through 1981. At that time the U.S. was not critically dependent on imports (except oil) and although the standard of living stagnated, it did not materially diminish. That round of inflation was ultimately ended by Federal Reserve Chairman Paul Volcker, who jacked interest rates up to levels sufficiently above the inflation rate so that the inflationary pressure from economic growth diminished. Based on that experience, the Federal Reserve believes that it can control inflation. And on the other hand it also remembers the Great Depression, and it is equally convinced that it has no means at all to stop a 1930's style deflationary spiral. For that reason the Federal Reserve's comfort zone is biased towards a moderate positive inflation rate, which it presumes that it can control. Unfortunately, the growth of real commerce in the United States has been so sluggish recently that domestic growth induced inflation has been minimal even as some "Main Street" asset classes (e.g., residential and commercial real estate) have likely continued to deflate. But what if the Federal Reserve "unthinkably" uses QE to "debase" the currency to induce external inflationary pressures? It could be argued that QE has already caused that to happen: year-over-year (March 2010 to March 2011) price indexes for imports have increased 9.7%, and over the same time period export prices have increased 9.5% -- causing current foreign trade price inflation to be very near the "magic" levels experienced in the late 1970's. If the total debt number was not a moving target (admittedly a hopeless "if" at the present time), a 1970's style 10% per annum inflation rate could reduce the "real" debt/GDP ratio by 38% in just 5 years (presuming that "real" GDP is at least flat, problematic at best in light of soaring energy and commodity costs). But at least a hypothetical new 62% debt/GDP ratio would be considered sustainable and credit worthy by nearly any international standards. Additionally, in such a scenario of QE generated substantial-but-not-hyper inflation those countries that currently peg their currencies to the dollar would be forced to un-peg -- and the U.S. would gain exporting advantages as "real" U.S. wages dropped to something much closer to global parity. In short, the U.S. would have won the "beggar thy neighbor" currency race to the bottom. The problem for the Federal Reserve is that it actually only has tools to control inflation generated by excessive domestic growth. And any prolonged periods of low or negative "real" interest rates relative to stable foreign currencies would result in substantial capital flight. Although it may be "unthinkable" that the Federal Reserve would consciously use QE to force inflation as a last ditch effort to offset an inherently deflating domestic economy, they may be heading (without thinking) in exactly that direction. Coming soon: "Unthinkables" that change regimes ... | |